Dow Theory is very basic and more than 100 years old but still remains the foundation of Technical Analysis.

WHAT IS DOW THEORY?

Dow Theory is named after Charles H Dow, who is considered as the father of Technical Analysis.

Dow Theory is very basic and more than 100 years old but still remains the foundation of Technical Analysis.

Charles H Dow (1851-1902), however neither wrote a book nor published his complete theory on the market, but several! followers and associates have published work based on his theory from 255 Wall Street Journal editorials written by him. These editorials reflected his belief on stock market behavior.

Some of the most important contributors to Dow Theory are:

- Samuel A. Nelson- He is the first person to use the term Dow Theory and he selected fifteen articles by Charles Dow for his book The ABC of Stock Speculation.

- William P. Hamilton- He wrote a book titled The Stock Market Barometer which is a comprehensive summary of the findings that Charles H Dow and Samuel A. Nelson have gathered.

- Robert Rhea- He wrote a book titled The Dow Theory.

- George E Schaefer- He wrote a book titled How I Helped More than 10000 Investors to profit in Stocks.

- Richard Russell- He wrote a book titled The Dow Theory Today.

SUPPORT AND RESISTANCE (SMALL INTRODUCTION)

Support:

1. A price point where the bear rally is arrested and the entry of bull rally is called support.

2. Support can be easily identified by a formation of V or U.

3. When there is multiple support at a single price point then it is considered as a support zone.

Resistance:

1. A price point where the bull rally is arrested and the entry of bear rally is called resistance.

2. Resistance can be easily identified by a formation of inverted V or U.

3. When there is multiple resistance at a single price point then it is considered as a resistance zone.

SIX PRINCIPLES OF DOW THEORY

1. First Principle : The Stock Market Discounts All Information.

2. Second Principle : The Stock Market Have Three Trends.

a. Primary Trend

b. Secondary trend

c. Minor Trend

3. Third Principle : Primary Trend Have Three Phases

a. Accumulation Phase

b. Participation Phase

c. Distribution Phase

4. Fourth Principle : Stock Market Indexes Must Confirm Each Other.

5. Fifth Principle : Volume Must Confirm the Trend.

6. Sixth Principle : Trend Remains Intact Until and Unless Clear Reversal Signals Occur First.

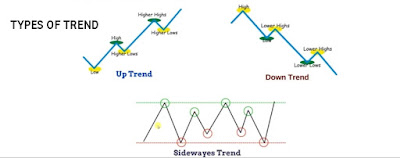

Dow defines "trend" as the direction in which the market moves. And based on this we have:

- An uptrend

- A downtrend

- A sideways trend

In a downtrend share prices move in the downward direction, making new lows in the process. Hence, the best indication of a downtrend is the prices making a lower high lower low.

COMMENTS