Tweezers Tops,Tweezers Bottoms,Candlestick Patterns,Japanese Candlestick Patterns,

Tweezers Top Candlestick Pattern

The tweezers top formation is considered as a bearish reversal pattern seen at the top of an uptrend.

The Tweezers Top Formation Consists of Two Candlesticks

- The first one is a bullish candlestick followed by a bearish candlestick. And the tweezers bottom formation consists of two candlesticks as well.

- The first candle is bearish followed by a bullish candlestick. So we can say that the tweezers bottom is the bullish version of the tweezers top.

The tweezers top occurs during an uptrend when buyers push the price higher, this gave us the impression that the market is still going up, but sellers surprised buyers by pushing the market lower and close down the open of the bullish candle.

This price action pattern indicates a bullish trend reversal and we can trade it if we can combine this signal with other technical tools.

Tweezers Bottom Candlestick Pattern

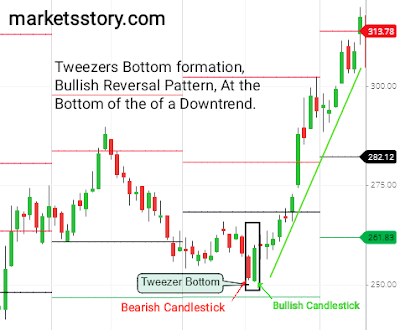

The tweezers bottom happens during a downtrend, when sellers push the market lower, we feel that everything is going all right, but the next session price closes above or roughly at the same price of the first bearish candle which indicates that buyers are coming to reverse the market direction. If this price action happens near a support level, it indicates that a bearish reversal is likely to happen.

The chart above shows us a tweezers bottom that occurs in a downtrend, the bears pushed the market downward on the first session.

However, the second session opened where prices closed on the first session and went straight up indicating a reversal buy signal that you can trade if you have other elements that confirm your buying decision.

Don’t focus on the name of a candlestick, try to understand the psychology behind its formation, this is the most important.

Because if you can understand why it was formed, you will understand what happened in the market, and you can easily predict the future movement of price.

COMMENTS