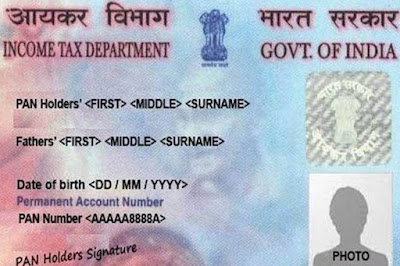

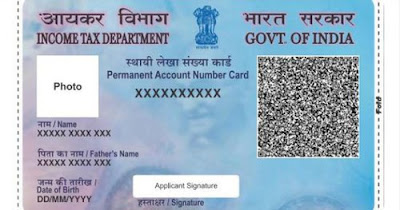

PAN – Permanent Account Number is a unique 10 digit number given by the Income Tax department to every entity (whether individual/company/others)

PAN – Permanent Account Number is a unique 10 digit number given by the Income Tax department to every entity (whether individual/company/others). It is one of the most primary and important proof of identification for any Entity (entity is as defined under the Income Tax Act of India 1961). A PAN is mandatory to file income tax returns.

PAN is basically unique identification number used to track financial transactions and to aid in avoiding tax evasion in monetary transactions. Getting a PAN is optional however certain instances mandate the requirement of PAN (eg: While filing returns, TDS, etc). Two separate entities cannot have the same PAN. Also, one entity cannot have multiple PAN’s.

How to apply for PAN?

PAN can be applied either Online or Offline. The form to be filled for PAN application is Form 49A (49AA in case of foreigner).

Offline Application Procedure:

Fill in the application form at the Authorised PAN centre ( https://www.tin-nsdl.com/pan-center.html) along with requisite documents.

Pay PAN processing fee.

PAN will be couriered to the Address mentioned.

Online Application:

As per incometaxindia.gov.in website, online application can be made either through the portal of

NSDL - https://tin.tin.nsdl.com/pan/index.html

UTITSL – https://www.pan.utiitsl.com/PAN/index.jsp??????

Charges for PAN:

The charges for applying for PAN is Rs. 93 (Excluding Goods and Services tax?) for Indian communication address and Rs. 864 (Excluding Goods and Services tax) for foreign communication address. Payment of application fee can be made through credit/debit card, demand draft or net-banking.

Once the application and payment is accepted, the applicant is required to send the supporting documents through courier/post to NSDL/UTITSL. Only after the receipt of the documents, PAN application would be processed by NSDL/UTITSL.

Documents required:

PAN requires two types of documents – Proof of Identity and Proof of Address and two recent colour photographs. Individuals are also required to submit proof of Date of birth and the name on PAN should match the proof.

For Extensive list of documents required for type of entity - https://www.tin-nsdl.com/services/pan/documents49A.html

Time limit for issue of new PAN – Once the form and documents are sent and are in order the PAN is issued within 48 hours but the physical card may take upto 2 weeks time.

Know your PAN:

Did you know every PAN is a 10 digit alphanumeric unique number.

The first five digits are alphabets, then 4 numbers and the last digit is a alphabet. (format : ABCDE1234F)

4 letter/digit - The fourth digit (alphabet) is to identify the type of entity, for eg:

P – Individual

F – Firm

C – Company

A – Association of Person

G – Government

B – Body of Individuals

E – LLP

H – HUF

T – Trust

5 letter/digit – The fifth digit in a PAN is an alphabet which is the 1 letter in the surname (last name) in case of PAN of an Individual or the First letter in the name in case of other entities like company/firm etc.

COMMENTS